3 Important Technical Analysis Lessons

Market Memory, Support Becomes Resistance, and Oversold Stocks Tend to Rally Off of Resistance

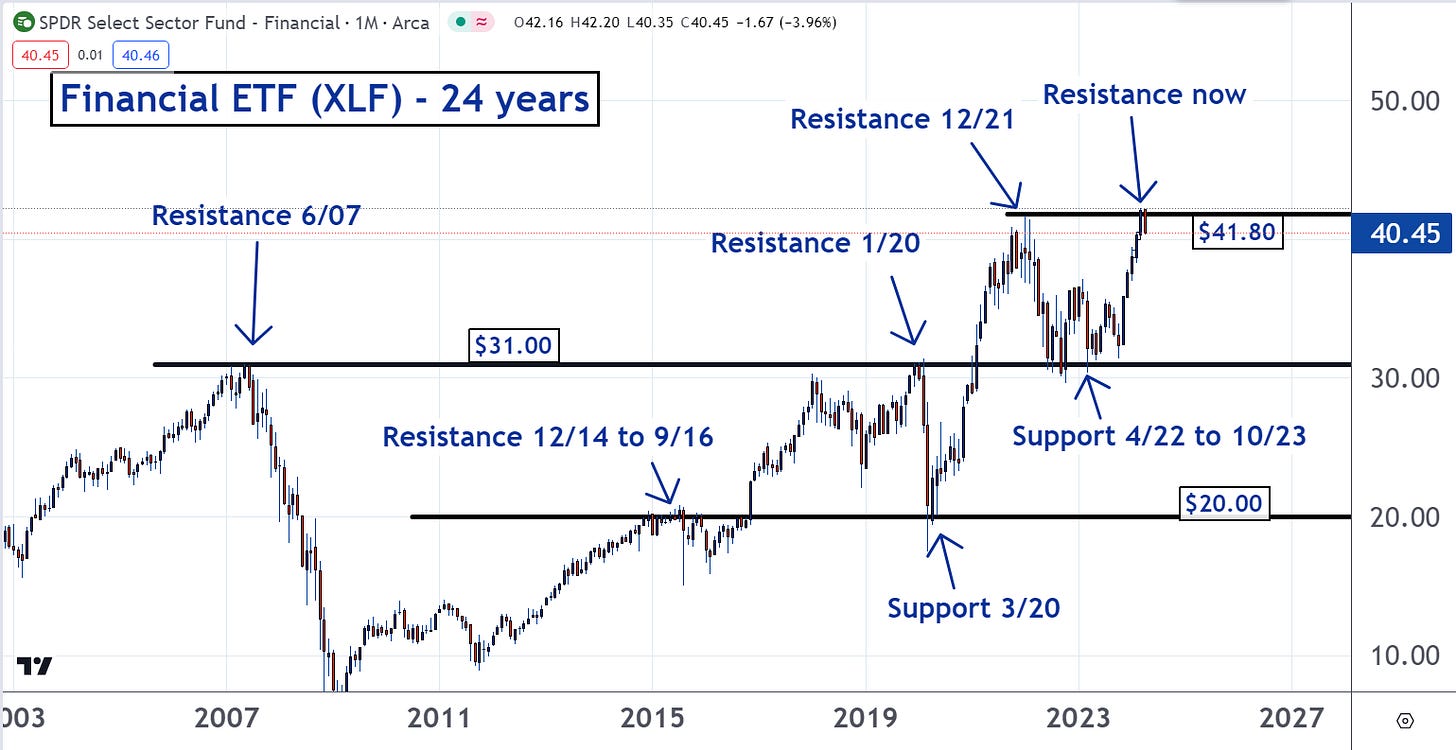

SPDR Financial Sector ETF (XLF) – Market Memory

It should come as no surprise that the Financial Sector ETF (XLF) has reversed and is now heading lower. The shares slammed into resistance at a former peak.

In financial markets, certain price levels are more important than others. These are called ‘support’ and ‘resistance’ levels. These levels can retain their importance for a long-time.

It could be months, years, or even decades. This is referred to as ‘market memory’.

XLF reversed off of resistance around $41.80. As you can see on the chart, this is where the peak was in December 2021.

Back in June of 2007, XLF first hit resistance at the $31.00 level. Thirteen years later this level was resistance once again in January 2020. Then it converted into and was support from April of 2022 through October 2023.

The $20 level was resistance from December 2014 through September 2016. Then it was the bottom in March of 2020 during the COVID Crash.

Market memory is an amazing thing. It’s hard to believe that a particular price level can retain its importance for such long time-periods

But charts don’t lie. As you can see with XLF, markets have a long memory.

If you can remember this, it will help you profit.

NVIDIA (NVDA) – Support Can Convert into Resistance

Some price levels are more important than others. As you can see on the chart, this has been the case with $865.00 for shares of NVIDIA (NVDA).

Over the past month, it has been a support level. Each time the shares fell to it, the buyers flooded the market and pushed the price higher.

But yesterday this support may have been broken. Now that the price is below what had been support, there will be a way to gain insight into whether a new downtrend will form or whether there will be a reversal.

If the level converts from support into resistance, there is a good chance it is the beginning of a new downtrend.

Many of the traders and investors who bought shares while they were at support came to regret their decisions to do so when the price fell below their buy price. A number of them decide to get out.

But only if they can do so without losing money…

As a result, they place sell orders at the level that was previously support. If there are enough of these sell orders it could convert what was support into resistance.

At this point, some of these sellers may sense that other sellers are coming into the market. This is why the resistance formed.

They become concerned that they may miss the trade if other sellers undercut them. They know that the buyers will go to whoever is willing to sell at the lowest price.

That could be what is about to happen here with NVDA. It could force the stock into a new downtrend. But if this conversion from support to resistance doesn’t occur over the next few days, there may be a rebound and move back up to the top of the range.

Sirius XM Holdings (SIRI) – Oversold Stocks Tend to Rally Off of Support

The stage may be set for shares of Sirius XM Holdings (SIRI) to rally.

‘Support’ is a price level where there is a large group of traders and investors who are looking to buy shares at or close to the same price. ‘Oversold’ means a market is trading below what is, or would be, its typical or average trading range.

As you can see on the chart, shares of SIRI have dropped to a price level that has previously been support. They are also oversold.

Both of these conditions will draw buyers into the market.

And these traders and buyers may sense that others who wish to buy are also coming into the market. They worry that they will miss their trade. They know the sellers will go to whoever is willing to pay the highest price.

Because of this, they increase the prices that they are willing to pay. But other buyers see this and do the same thing. This action could result in a snowball effect that pushes the price higher.

This could force the shares into a new uptrend.